In fintech and payments, where digital transactions power everything from everyday purchases to complex business operations, delivering an exceptional user experience (UX) is not just a nice-to-have—it’s a critical differentiator. Fintech companies like payment processors, mobile wallets, and merchant platforms handle sensitive financial data and high-stakes interactions, making UX flaws particularly costly.

According to industry reports, poor UX can lead to abandonment rates as high as 70% during checkout processes, resulting in billions in lost revenue annually. These challenges often manifest subtly, such as through job postings that highlight the need for specialized designers to tackle persistent issues. Drawing from real-world trends and expert insights, this article explores five prevalent UX hurdles in the payments sector.

We’ll talk why they occur, their impacts on users and businesses, supported by examples and statistics, and provide in-depth strategies for resolution. By addressing these, fintech firms can foster trust, boost user retention, and drive sustainable growth in a competitive market.

1. Suboptimal User Interfaces and Fragmented Experiences

One of the most pervasive issues in fintech payments is the presence of confusing interfaces that fail to guide users intuitively through transactions. This often stems from overly complex layouts, inconsistent visual elements, or designs that don’t adapt well across devices—such as a seamless mobile experience that falls apart on desktop.

For instance, unclear navigation can force users to hunt for basic functions like viewing transaction history or initiating refunds, leading to frustration and errors. In fintech, where speed and accuracy are paramount, these flaws exacerbate problems like cart abandonment; studies show that 68% of users abandon online purchases due to complicated checkout processes.

Moreover, accessibility barriers, such as poor color contrast or lack of screen reader support, alienate users with disabilities, violating standards like WCAG and potentially exposing companies to legal risks. Fragmented experiences across platforms compound this, as users expect uniformity—swiping on a phone should mirror clicking on a web app.

Real-world examples include early versions of some mobile payment apps where button placements varied between iOS and Android, causing confusion and higher support tickets. This not only erodes user trust but also increases operational costs for businesses, as they deal with more customer complaints and lower conversion rates.

How to Overcome It: To tackle this, adopt a comprehensive human-centered design methodology that prioritizes empathy and iteration. Start by conducting a thorough UX audit of your current interfaces, using tools like heatmaps to identify pain points.

Then, leverage prototyping software such as Figma to create wireframes that ensure consistency across iOS, Android, and responsive web environments. Implement responsive design principles, ensuring elements like buttons and forms scale appropriately without losing functionality. Incorporate accessibility from the outset by following WCAG guidelines—test for color contrast ratios above 4.5:1 and ensure keyboard navigation works flawlessly.

Collaborate with developers early to align on technical constraints, and run A/B tests to validate improvements. For example, simplifying a checkout flow from five steps to three can reduce abandonment by up to 30%. The benefits are multifaceted: enhanced user satisfaction leads to higher retention, while streamlined interfaces can cut support queries by 20-40%.

Ultimately, this approach transforms potential frustrations into delightful, efficient experiences that build long-term loyalty.

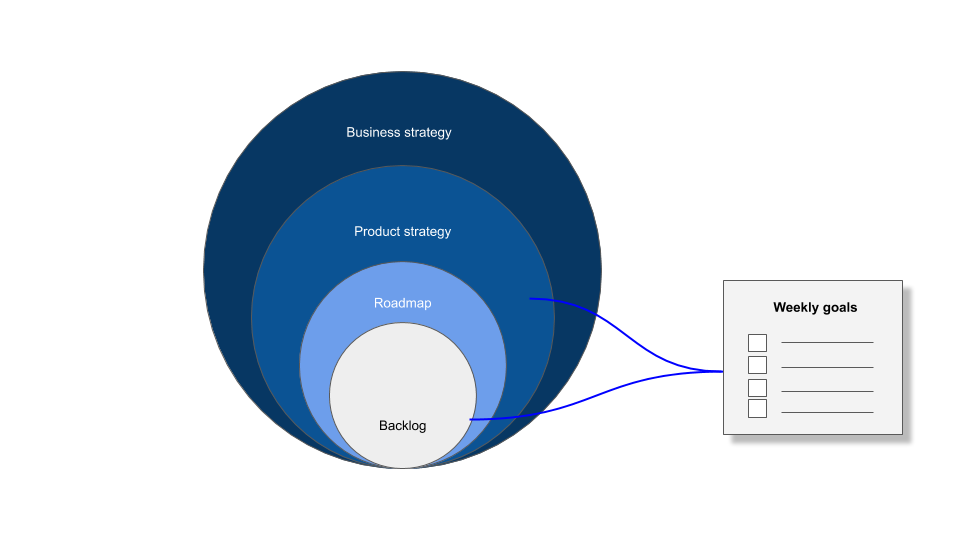

2. Lack of Deep User Insights and Data-Driven Decisions

Fintech payments often fall short when products are developed based on internal assumptions rather than genuine user data, resulting in features that don’t resonate with real needs. This manifests in mismatched functionalities, such as convoluted reporting tools that overwhelm small business owners or checkout flows ignoring cultural preferences in global markets.

Without robust insights, companies miss critical pain points—like the anxiety users feel during high-value transactions due to unclear security cues. Statistics reveal that 75% of fintech users prioritize ease of use, yet many apps fail here because decisions aren’t evidence-based, leading to high churn rates of up to 50% in the first month.

For example, in anti-money laundering (AML) and know-your-customer (KYC) processes, lengthy forms without progress indicators can cause drop-offs, as users perceive them as burdensome rather than protective. This gap arises from insufficient research, where teams overlook diverse user behaviors, mental models, and contexts, ultimately stifling innovation and user adoption.

How to Overcome It: The key is to embed ongoing user research into your product lifecycle, transforming assumptions into actionable intelligence. Begin by planning a mix of qualitative and quantitative methods: conduct in-depth interviews with 20-30 merchants to uncover behaviors, deploy surveys via tools like Typeform to gather broad feedback, and perform usability testing with prototypes to observe interactions in real-time.

Analyze results to craft detailed user personas—e.g., a “busy small business owner” who needs quick dashboards—and journey maps that highlight friction points. Foster a data-driven culture by integrating analytics from tools like Google Analytics or Mixpanel to track metrics such as task completion rates. Encourage constructive debate in team reviews to refine designs iteratively.

For instance, one fintech firm reduced onboarding time by 40% after research revealed users needed simpler language in forms. This not only aligns products with user needs but also minimizes costly redesigns, boosts satisfaction scores, and enhances competitive positioning through personalized, empathetic solutions.

3. Innovation Stagnation and Falling Behind Emerging Trends

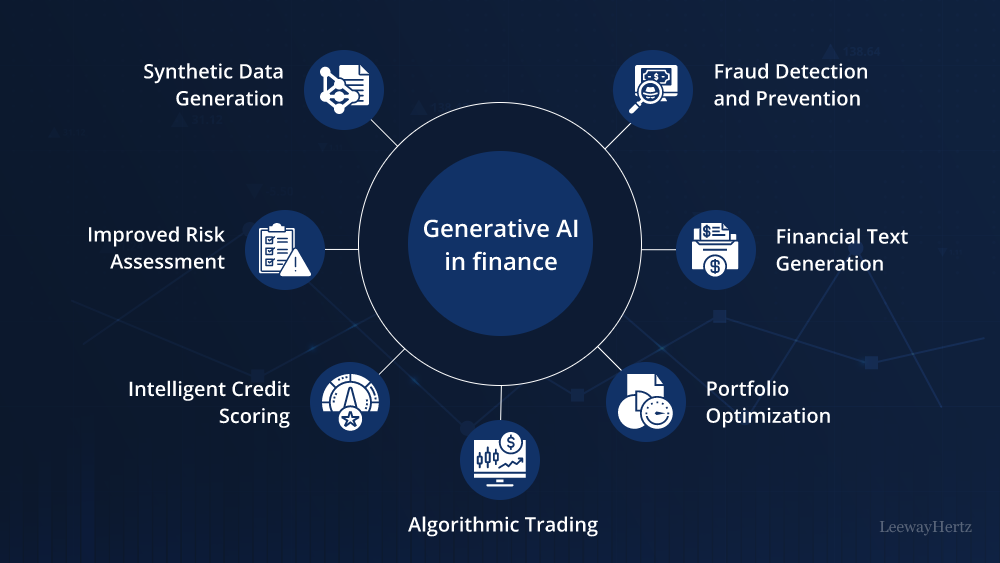

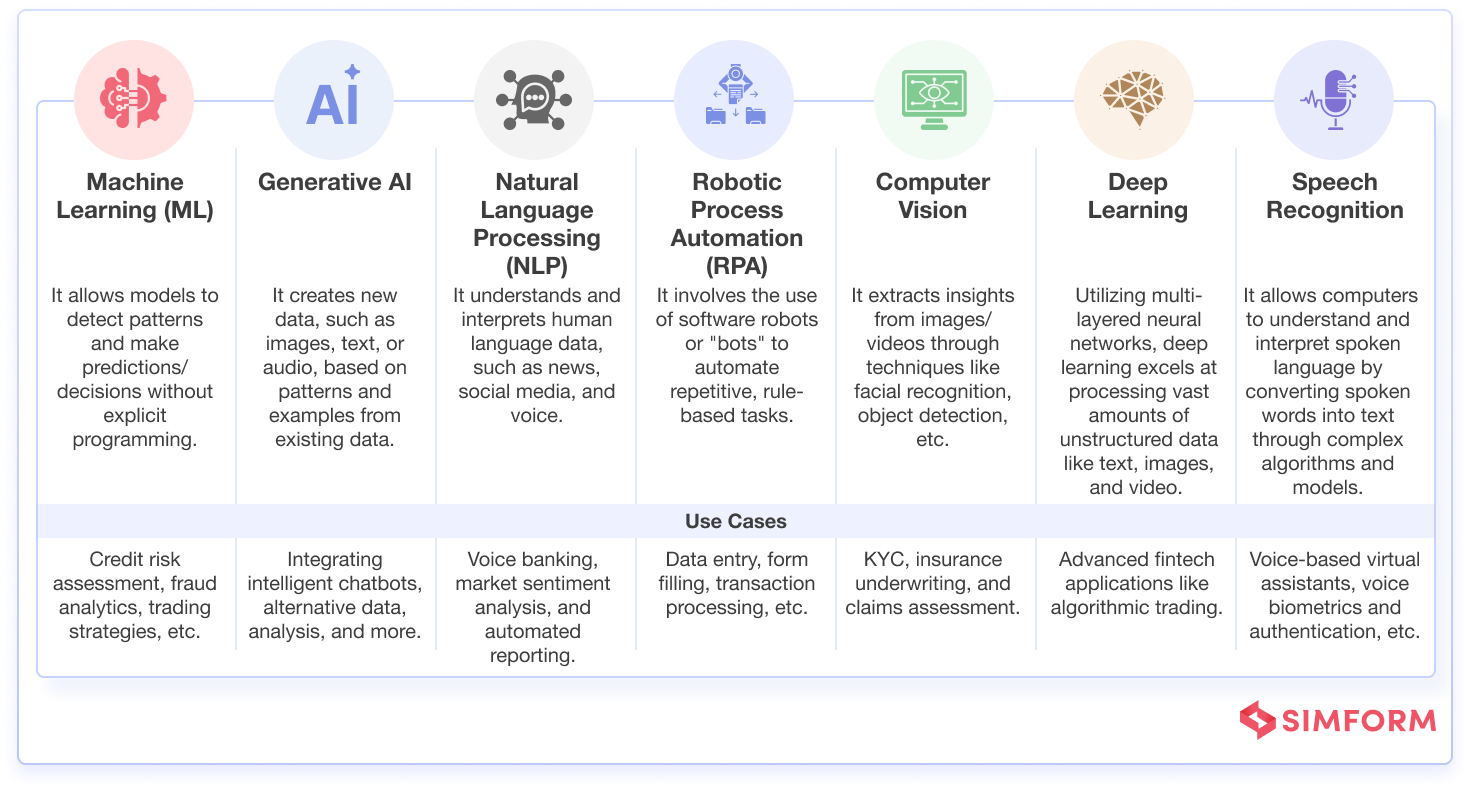

In a sector driven by technology, fintech payments risk obsolescence if they don’t evolve beyond core functionalities, particularly with advancements like AI and blockchain. Stagnation occurs when teams focus solely on compliance and basics, neglecting features like real-time fraud alerts or personalized recommendations, leaving users underserved.

This is evident in apps that lack integration with emerging tools, such as voice-activated payments or predictive analytics for cash flow forecasting. Industry data indicates that 60% of fintechs struggle with innovation due to resource constraints, resulting in user migration to more dynamic competitors. For older demographics, this means exclusion from services post-branch closures, with over 100,000 elderly users affected by inaccessible digital interfaces.

Without forward-thinking, companies miss opportunities to leverage AI for enhanced security or user engagement, leading to flat growth and diminished market share.

How to Overcome It: Combat stagnation by cultivating a proactive innovation ecosystem within your organization. Dedicate time for horizon-scanning: subscribe to resources like Fintech Magazine and attend conferences to track trends. Experiment with AI integrations, such as machine learning models for predictive fraud detection, starting with small pilots using frameworks like TensorFlow.

Collaborate with external experts or partners to prototype “future-forward” features, like AI chatbots for instant support. Implement agile methodologies to test and iterate quickly, measuring success through KPIs like user adoption rates. A notable example is how some platforms incorporated biometric authentication, reducing fraud by 25% while improving UX.

This strategy not only keeps your product relevant but also attracts tech-savvy users, increases revenue through premium features, and positions your brand as a leader in transformative financial experiences.

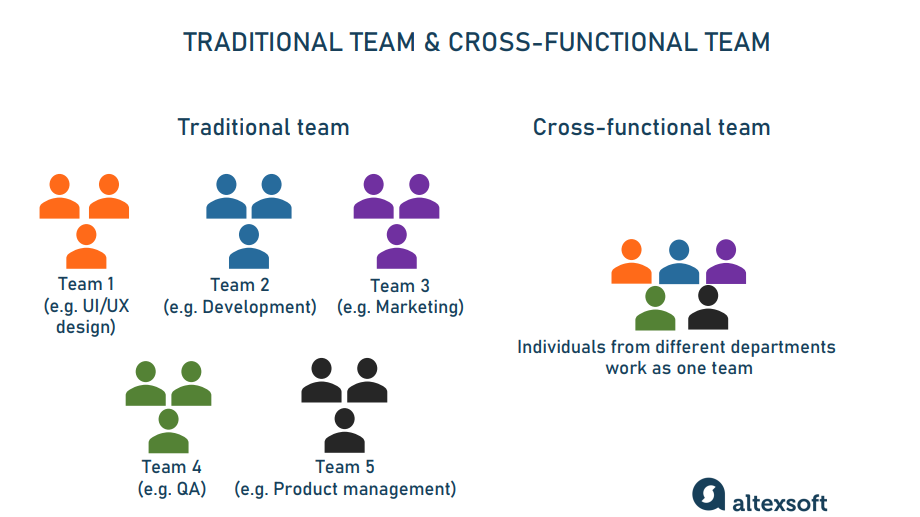

4. Collaboration Gaps Across Teams

Fintech development often suffers from silos, where designers, developers, product managers, and stakeholders operate in isolation, leading to products that prioritize one aspect—say, aesthetics—over others like feasibility or business alignment. This results in miscommunications, such as designs that ignore engineering constraints, causing delays and rework.

In payments, where regulatory and security demands are high, these gaps can introduce vulnerabilities or non-compliant features. Research shows that poor cross-functional collaboration contributes to 40% of project failures in tech. Examples include teams where UX feedback is dismissed, leading to apps with intuitive designs but slow performance, eroding user trust and increasing churn.

How to Overcome It: Bridge these gaps by establishing cross-functional teams from the project’s inception, using shared tools like Slack or Miro for real-time collaboration. Schedule regular design reviews and workshops where all voices contribute, promoting systems thinking to balance user needs with technical realities.

Train teams on agile practices, ensuring daily stand-ups and retrospectives foster open dialogue. For instance, adopting a “product triad” model—designer, PM, engineer—can streamline decisions and reduce timelines by 30%. The payoff includes faster time-to-market, higher-quality products, and a collaborative culture that innovates more effectively, ultimately delivering cohesive experiences that meet multifaceted demands.

5. Shortfalls in Domain-Specific Expertise

Generic UX approaches in fintech often overlook industry nuances, such as intricate transaction flows or stringent regulations, resulting in tools that feel out of touch. For example, ignoring KYC requirements can lead to clunky verification processes that frustrate users while risking non-compliance fines. Without deep domain knowledge, designs may not address security perceptions or financial literacy variations, leading to trust issues—critical since 80% of users demand robust privacy in fintech apps. This shortfall is common in startups scaling quickly, where broad UX skills don’t suffice for specialized needs like MAS guidelines in Singapore or GDPR in Europe.

How to Overcome It: Build expertise by hiring or consulting fintech-savvy UX professionals who understand regulatory landscapes and user behaviors in finance. Maintain detailed documentation, including user flows and compliance checklists, to ensure consistency. Partner with legal experts early and conduct domain-specific training.

For tailored solutions, use frameworks like atomic design to create scalable components that embed compliance seamlessly. One success story: a platform revamped its KYC UX with expert input, cutting verification time by 50% and boosting completion rates.

This enhances credibility, reduces risks, and creates intuitive products that resonate deeply with users, fostering loyalty and growth.

Addressing these UX challenges holistically can elevate your fintech payments platform from functional to exceptional, turning potential pitfalls into opportunities for differentiation. If your team is grappling with similar issues, consider a professional UX consultation to uncover tailored strategies—reach out today for expert guidance!

Leave a Reply